Standard Deduction 2023-2024: Prepare for Your Taxes

With the 2024 tax deadlines quickly approaching, it's crucial to have a clear understanding of the 2023 standard deductions. This key element of the tax process not only simplifies filing but also has a substantial impact on your overall tax liability. Keep in mind, when filing your taxes in 2024, you want to focus on the 2023 tax rates.

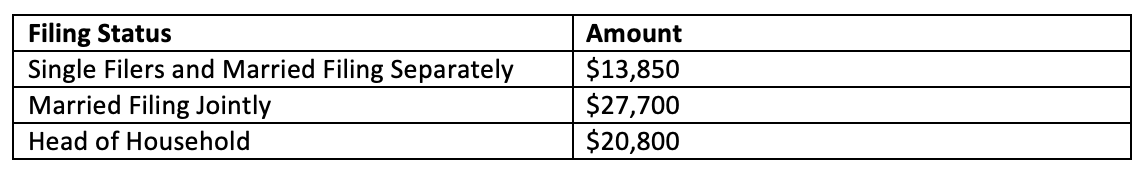

The 2023 Standard Deduction Amounts

For the 2023 tax year, the IRS has adjusted the standard deduction amounts to keep pace with economic changes, primarily inflation. Here’s what you need to know:

Additional Deductions for Seniors and Individuals with Visual Impairments

There are additional deductions for senior and individuals with visual impairments, which are as follows:

Single or Head of Household:

If you’re 65 or older, or blind, you get an additional $1,850. For those 65 or older and blind, the addition is $3,700.

Married Filing Jointly or Separately:

Each qualifying individual who is 65 or older, or blind, gets an additional $1,500.

If you’re both 65 or older and blind, the additional amount is $3,000 per individual.

These extra deductions can significantly lower taxable income for eligible filers.

Conclusion

The 2023 standard deduction is important to understand for this tax filing season. Being well-informed about these deductions can lead to significant tax savings. Equally important is filing your taxes on time to avoid penalties. Remember, the standard deadline for individual tax returns is April 15 and can be extended until October 15.