Full Guide to the 2024 CPA Exam Changes

The CPA Exams Are Facing Major Changes Starting January 1, 2024

Have you heard about the major changes coming to the CPA exam starting January 1, 2024? You need to make sure you’re ready for them! These changes are going to affect how your CPA credits are treated, the exam release test windows, and new exam topics!

New Exam Structure

Under the next exam format, students all take the same core exams (FAR, REG, Audit). For the fourth exam, they choose between three discipline exams.

Now what you don't notice is the BEC exam. The BEC exam is essentially disappearing and all of its content is getting moved to the business analysis and reporting (BAR) discipline exam.

FAR Exam Content Changes

Certain advanced accounting topics will be removed from new FAR core exam. These topics will be moved to the business analysis and reporting (BAR) discipline exam. For example, the advanced governmental accounting topics will be removed from the FAR exam and moved to the BAR exam. The basic governmental accounting topics will still be tested on the FAR core exam.

Another example is with leases. The new FAR core exam will only test leases from the lessee’s perspective. The lessor’s perspective will now be tested on the BAR exam.

Here’s a list of the main topics being removed from the FAR Exam:

Advanced Governmental Accounting

Lessor Accounting

Consolidating Journal Entries

Impairment of Goodwill

Software Costs

Research and Development Costs

Derivatives and Hedge Accounting

Employee Benefit Plans

REG Exam Content Changes

What’s happening to the new REG core exam? Just like with the FAR exam, certain advanced tax topics are being removed from the REG exam and moved to the taxation compliance and planning (TCP) discipline exam. For example, the new REG core exam will test only cash distributions but not property distributions (this is great for those who despise basis calculations). Property distributions will not be tested on the TCP discipline exam.

Here’s a list of the main topics being removed from the REG Exam:

Property Distributions

Passive Activity Limitations

Gift Taxes

Net Operating Losses

Non-Cash Donations

Child’s Investment Income

Consolidated Tax ReturnsInternational Tax Topics

Trust Taxation

Section 1231, 1245, and 1250 Transactions

Audit Exam Content Changes

What’s going to change with the audit core exam? Very little. The exam content is not being moved anywhere, it’s staying on the audit core exam.

Business Analysis and Reporting (BAR) Discipline Exam

You’re going to want to take this discipline exam is you thrive in the advanced FAR topics and BEC topics. 40-50% of your BAR score will be from BEC topics. The remaining portion will 50-60% is from advanced FAR topics.

Here’s a detailed outline of the BAR exam topics (based on the AICPA blueprints):

Part 1: Business Analysis (40-50%)

Cost Accounting

Economics

Capital Structuring

Part 2: Technical Accounting and Reporting (35-45%)

Consolidating Journal Entries

Impairment of Goodwill

Software Costs

Research and Development Costs

Derivatives and Hedge Accounting

Employee Benefit Plans

Lessor Accounting

Part 3: State and Local Government (10-20%)

Government-Wide Financial Statements

Budgetary Accounting

Encumbrance Accounting

The AICPA blueprints provide a detailed outline of each topic on the new exams.

Information Systems and Controls (ISC) Discipline Exam

The next discipline exam is called Information Systems and Controls. The ISC exam heavily tests information systems (i.e., IT processes). This exam includes everything from data management to mitigating cyber attacks. If you enjoy IT topics and information systems, then this is your exam.

Here’s a detailed outline of the ISC exam topics (based on the AICPA blueprints):

Part 1: Information Systems and Data Management (35-45%)

IT Infrastructure

Enterprise Resource Planning

System Change Management

Data Storage Methods

Part 2: Security, Confidentiality and Privacy (35-45%)

Types of Security Threats

Mitigating a Security Attack

Part 3: SOC Engagements (15-25%)

Types of SOC Engagements

How to Perform SOC Engagements

The AICPA blueprints provide a detailed outline of each topic on the new exams.

Tax Compliance and Planning (TCP) Discipline Exam

The third discipline exam is called Tax Compliance and Planning (TCP). This discipline focuses on advanced tax topics. It includes topics such as passive activity losses, alternative minimum tax (AMT), and property distributions.

Here’s a detailed outline of the TCP exam topics (based on the AICPA blueprints):

Part 1: Tax Compliance and Planning for Individuals (30-40%)

Passive Activity Limitations

Alternative Minimum Tax (AMT)

Child’s Investment Income

Non-Cash Donations

Gift Taxes

Part 2: Entity Tax Compliance (30-40%)

C Corps, S Corps, Partnerships

Basis with Property Distributions

Net Operating Losses

Trust Taxation

International Tax Topics

Part 3: Entity Tax Planning (10-20%)

Tax Planning

Part 4: Property Transactions (10-20%)

Section 1231, 1245, and 1250 Transactions

Related Party Rules

The AICPA blueprints provide a detailed outline of each topic on the new exams.

Which Discipline Exam Should I Take?

You might be wondering which discipline exam is best to take. My first advice is to consider which CPA topics you thrive in.

Remember the emphasis of each discipline exam: The business analysis and reporting (BAR) exam consists of BEC topics and advanced FAR topics. The tax compliance and planning (TCP) exam consists of advanced tax topics. The Information Systems and Controls (ISC) exam focuses on informatio systems and information technology.

If you are indifferent between these topics, I would recommend taking the BAR exam. Since the BAR exam involves topics already tested on FAR and BEC, then students will have a fairly accuracy idea of how the toppics will be tested. Yet with the new ISC exam, it’s difficult to know how the topics will be tested. I consider the BAR exam to be the most predictable exam out of the three (not the easiest, just the most predictable). When I say predictable, I refer to know how the various topics are tested. The next most predictable exam is TCP, because the REG exam is already daily predictable. The ISC is the least predictable of the exams.

Important Dates for the CPA Exam Changes

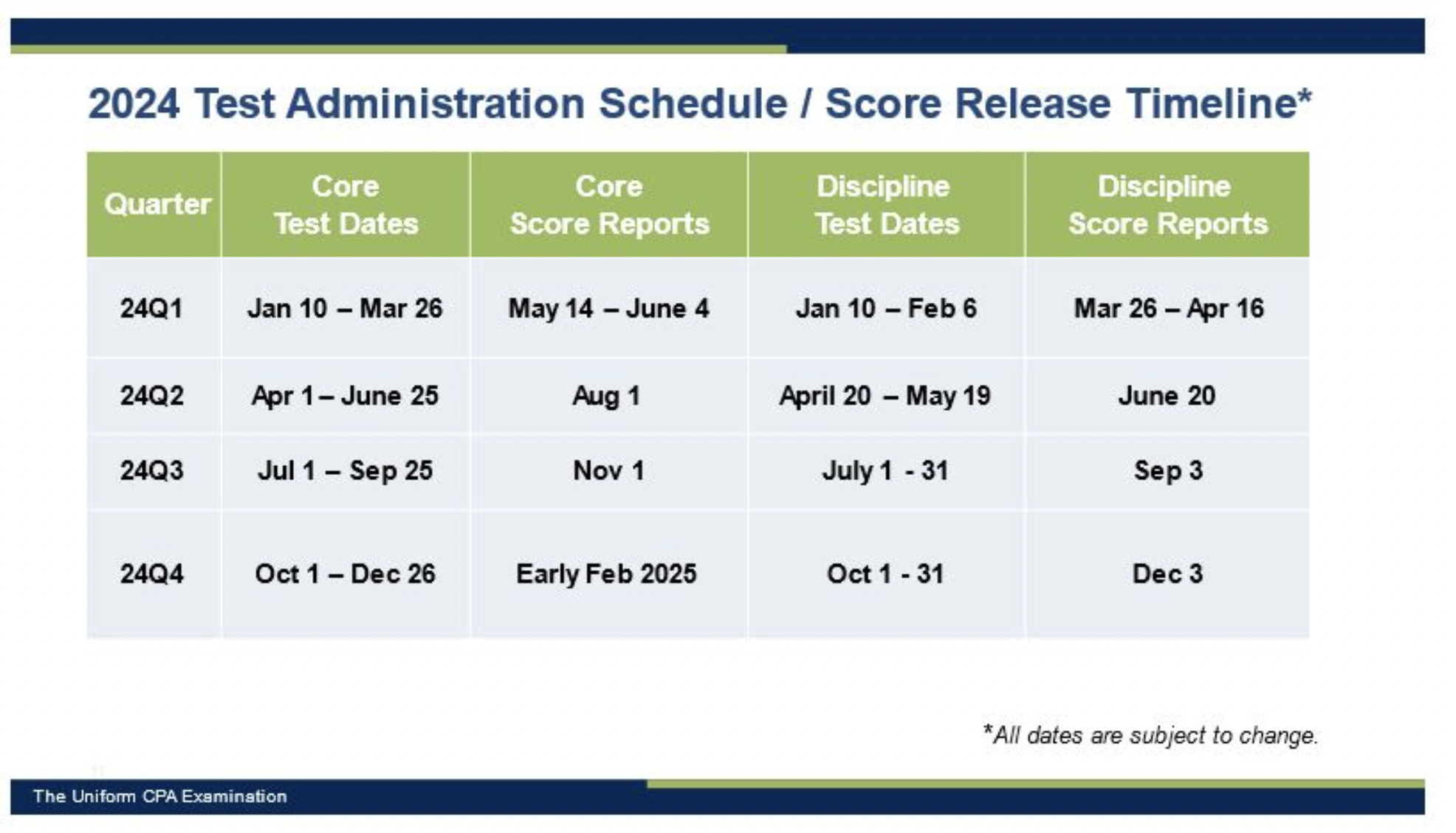

The new CPA format will first be tested on January 10, 2024. In 2024, the CPA exam results are only being released once per quarter. This means that students are going to be facing long waits for their exam results. Take a look at the 2024 release schedule below:

Source: NASBA

Because of this long date for releasing exam results, NASBA has suggested that every student’s CPA credits as of January 1, 2024 are automatically extended to June 30, 2025. Each board of accountancy must officially approve this extension. Check on the updated list of states approved here. To date, the only states that have not approved the extension are Florida, Maine, Wisconsin, California and Arizona.

Conclusion

Students should spend significant time learning about the new exam format starting January 1, 2024. The changes will affect various aspects of the student’s journey. I wouldn’t consider these changes all good or all bad. The new discipline approach provides students with the option to avoid certain advanced topics and to focus on a discipline exam that they understand better.

In summary, I hope this full guide on the 2024 exam changes has helped you. If you have any questions or comments, you can reach Kyle directly at kyle@maxwellcpareview.com.