Mastering Bond Accounting for the CPA Exams

As aspiring CPAs, it's critical to understand the fundamentals of bond accounting. On the CPA exams, bond questions regularly appear, but the good news is that they are predominantly logical and calculation-based. Once you've grasped the theory, you'll find them highly predictable. Today, we'll dissect bond accounting, explore a comprehensive bond example, and highlight the amortization schedule.

Bonds are essentially forms of debt where the issuer receives cash in exchange for a promise to pay interest over time, and to repay the principal amount at a future date. When a bond is issued, cash is debited, and bonds payable is credited for the face value of the bond. Often, the actual cash proceeds diverge from the face value because the bond's stated interest rate varies from the prevailing market rate or the effective rate.

The bond's stated rate determines the annual cash payments. If you're offering a 5% stated rate but the market's offering a 6% effective rate, your bond is less attractive, hence it's issued at a discount. Conversely, if you offer a 4% stated rate when the market is offering 3%, your bond is more appealing and can command a premium. This discount or premium must be amortized over the life of the bond.

Let's walk through a detailed example. Suppose on January 1, Year 1, Bluestone Corp issued 6% seven-year bonds with a face value of $300,000, paying interest annually. The market interest rate was 5%, and the bond proceeds were $317,359, signifying a premium because Bluestone offered a better rate than the market.

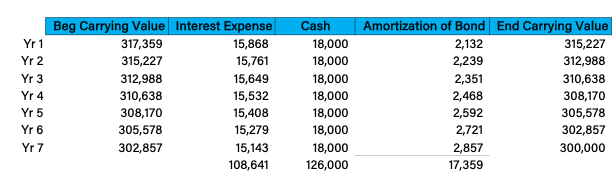

To approach any bond question effectively, create an amortization schedule for the bond's entire lifespan. This tool not only improves your conceptual understanding but helps you answer any question with precision. Start with the beginning carrying value of the bond, which in this case is $317,359. Compute the annual interest expense by multiplying the carrying value by the market rate. Deduct this interest expense from the fixed annual cash payment to determine the premium's amortization.

Full Amortization Schedule

Over time, the bond premium decreases, reflecting the bond's diminishing carrying value. As the carrying value approaches the initial face value of $300,000, the bond's premium is gradually amortized. Consequently, the interest expense declines because it is calculated as a percentage of a decreasing amount. The difference between the decreasing interest expense and the constant cash payment grows, leading to a greater amortization of the bond premium.

Let's translate this into journal entries. The initial entry credits the full face value of the bond to bonds payable, debits cash for the proceeds, and credit premium. At the end of each year, cash is credited for the fixed annual payment, and the premium is amortized by the difference between the interest expense and the cash. The carrying value of the bond decreases accordingly, affecting the next year's interest expense calculation. Finally, when the bond's term ends, the face value is paid back by debiting bonds payable and crediting cash for the face value of $300,000. The journal entries for all 7 years of the bonds are as follows:

All Journal Entries

An integral part of bond accounting is to accurately calculate and record the amortization of the bond premium or discount. Grasping this concept can help you to confidently pass the FAR exam!